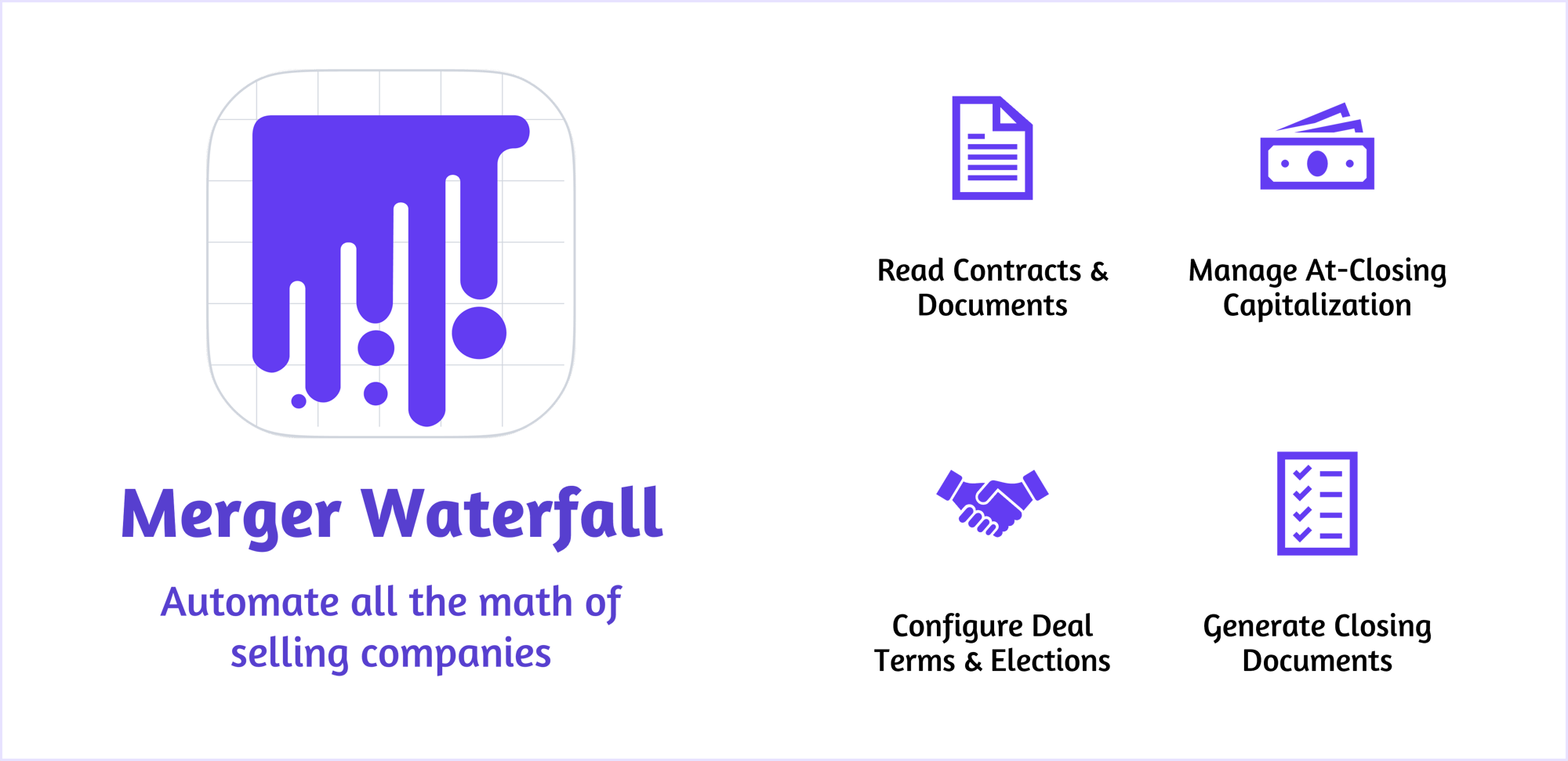

Merger Waterfall

Waterfall Studio automates the math of M&A transactions

We leverage agreements in source documents (e.g. Cap Table, Term Sheet, COI) and dynamically incorporate expert inputs to show the impact of negotiations in real and planned M&A transactions.

Companies are sold in all sorts of creative fractions

- Acquisition / Dissolution - Sell entire company

- Merger - Sell and trade parts of your company

- Equity Financing - Sell shares in your company

- Debt Financing - Sell obligations to pay before you can sell your company

- Complex Transactions - Trade obligations and ownership to your company

Each Sale type triggers unique math

- Ownership changes must be accurately tracked

- Terms must be accurately honored for all stakeholders

- Funds must be correctly allocated and distributed

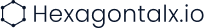

Ownership can be hard to figure at closing

It’s typically impractical and unprofitable to obsess over ownership while operating a young business, and each layer of this onion is typically some added work for the dealmaker at the time of closing.

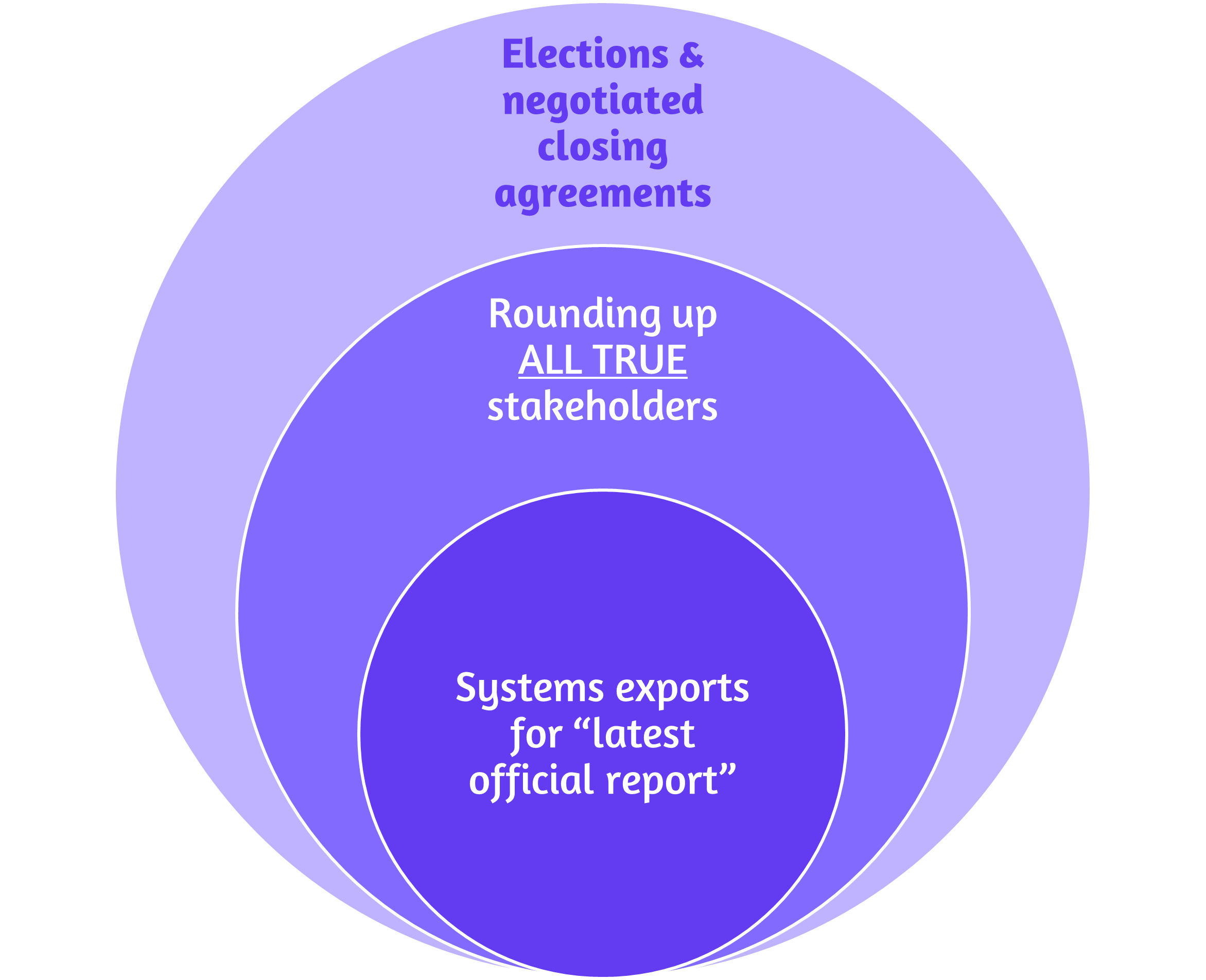

Terms of the deal must face a lot of the past

Prior agreements with investors, employees and other stakeholders will guiding and constrain how the deal term sheet will apply

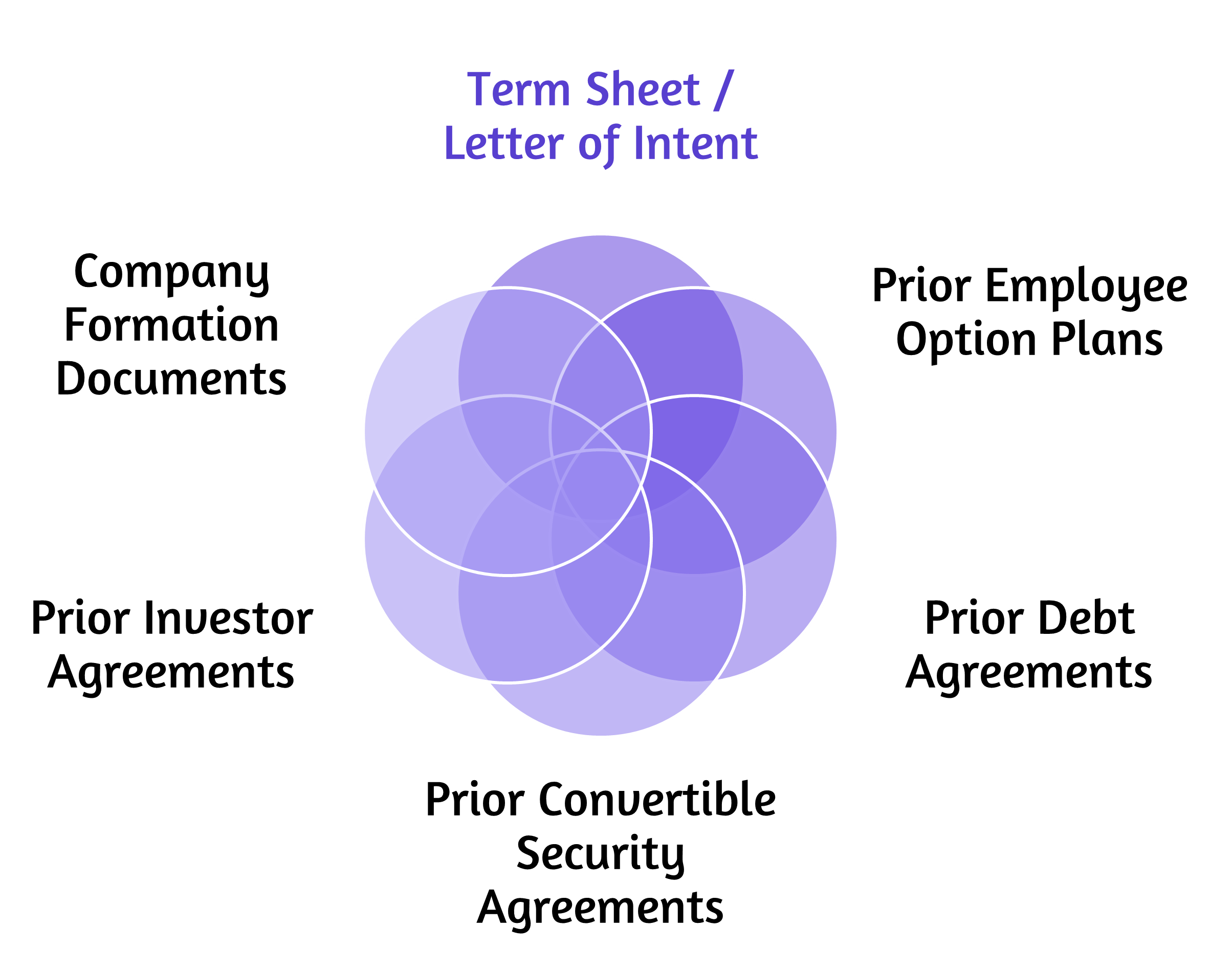

Distributions of stock or cash with various strings

Sale proceeds are in various forms, with unique terms for when and how they’ll manifest for each stakeholder

Trusted by leading companies